Se společností Agora se navázala spolupráce v roce , kdy se stala oficiálním distributorem mobilních telefonů Samsung. Za krátkou dobu odvedla skvělou práci, ať už se jedná o pokrytí prodejních kanálů, plnění společných cílů nebo o různé aktivity na podporu prodeje Jul 01, · Homework Solutions 1. Mastering Payroll Similarly,blogger.com,somestatesmaketheclient firmpay. ** Starting in , employers must withhold—and self-employed individuals must pay—additional Medicare tax of % of wages above $, The additional Medicare tax is not reflected in this chart% May 12, · homework solutions mastering payroll Page 22/ Download Ebook Mastering Payroll Test Bank Solutions interested in mastering payroll homework solutions mastering depreciation testbank solutions'' TestBankTeam Com Test Bank And Solution Manual May 14th, - Latest Test Banks And Solution Manual For All Subjects' 'Solution Page 23/35

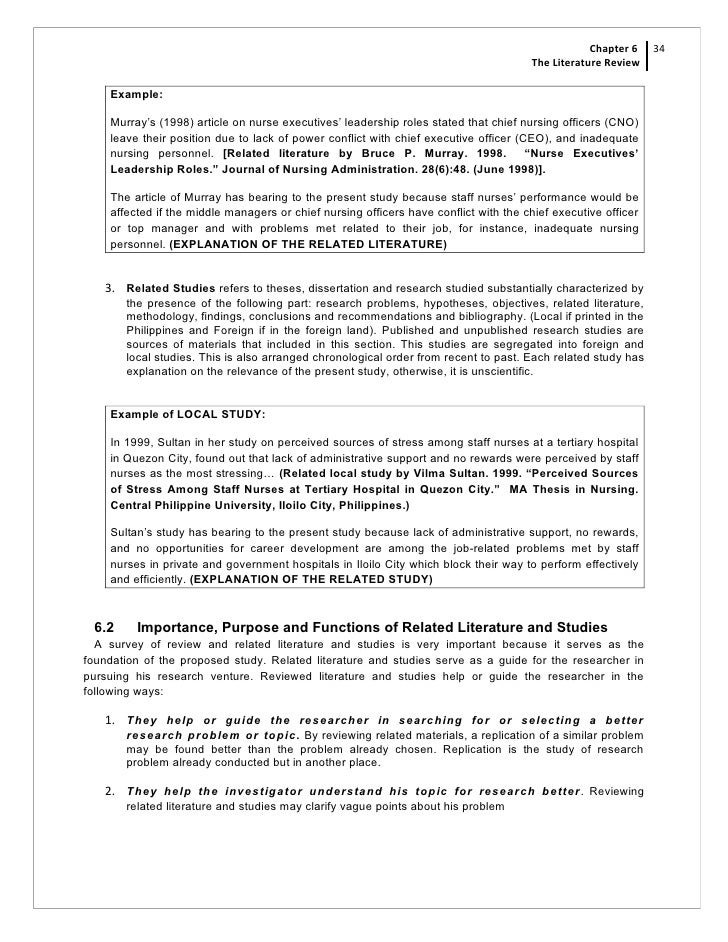

Mastering Internal Controls and Fraud Prevention

Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website. See our User Agreement and Privacy Policy. See our Privacy Policy and User Agreement for details. Home Explore Login Signup.

Successfully reported this slideshow. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. You can change your ad preferences anytime, mastering payroll homework. Mastering Internal Controls and Fraud Prevention. Upcoming SlideShare. Like this presentation? Why not share! Embed Size px. Start on. Show related SlideShares at end. WordPress Shortcode. Like Liked, mastering payroll homework. Full Name Comment goes here.

Are you sure you want to Yes No. Dawn Raye Cain, mastering payroll homework. Lorena Villa. Show More. No Mastering payroll homework. Views Total views. Actions Shares. No notes for slide, mastering payroll homework.

Mastering Internal Controls and Fraud Prevention 1. Mastering Internal Controls and Fraud Prevention Mastering Internal Controls and Fraud Prevention American Institute of Professional Bookkeepers © American Institute of Professional Bookkeepers, 2.

Mastering Internal Controls and Fraud Prevention Helpful definitions Bribery—money or favors offered or given to influence the conduct or views of a person in a position of trust Consent decree—an agreement between two parties sanctioned by the court Example: A company or individual consents agrees to stop questionable practices without admitting guilt Terminology 3, mastering payroll homework. Mastering Internal Controls and Fraud Prevention Terminology Fraud—intentional deception perpetrated to secure unfair or unlawful gain Larceny—unlawfully taking something— i.

If the stolen item s are of great value, such as a large amount of money, it is grand larceny Prima facie evidence—evidence that appears to be sufficient to establish facts unless rebutted, such as a person found at mastering payroll homework murder scene holding a weapon 5, mastering payroll homework.

Mastering Internal Controls and Fraud Prevention Terminology Subrogation—substitution of one entity or person for another. Example: Under subrogation, when an employer discovers that a bonded employee has embezzled funds, the insurance company takes the place of the employer to obtain return of the funds 6.

Mastering Internal Controls and Fraud Prevention Four Types of Noncash Theft 1. Unconcealed larceny theft of physical assets 2. Falsified shipping or receiving reports 3.

Fraudulent shipments 4. Fraudulent write-offs 7. Mastering Internal Controls and Fraud Prevention Unconcealed Larceny Review: Larceny is unlawfully taking something from another entity or person Why is unconcealed larceny not reported?

labor Poor channels of communication Personal involvement in the theft Fear of job loss if the thief is a superior 8. Mastering Internal Controls and Fraud Prevention Fraudulent Write-offs Fraudulent write-offs can take many forms: Forcing the reconciliation of accounts Example: Stealing goods, then covering up the theft with a journal entry, mastering payroll homework, such as: COGS XXX Inventory XXX Altering inventory records Example: The thief overstates the physical count of goods on hand to match the altered records, mastering payroll homework, thus covering up the theft Mastering Internal Controls and Fraud Prevention When there is no centralized departmentWhen there is no centralized department to receive and store merchandiseto receive and store merchandise Mastering Internal Controls and Fraud Prevention Red Flags of Mastering payroll homework Theft These include see workbook pages : High levels of inventory shrinkage Frequent customer complaints about shipment shortages Unsupported adjustments to perpetual inventory records Excessive purchases of materials or merchandise An unexplained increase in COGS as a percentage of sales Proper documentation, mastering payroll homework monitored Purchase orders, receiving reports, mastering payroll homework, sales orders, mastering payroll homework, and shipping documents should be pre-numbered and the numerical sequence monitored Shipping documents should require a sales order Paying an invoice should require supporting documents—a purchase order and receiving report Five Inventory Internal Controls Mastering Internal Controls and Fraud Prevention Five Inventory Internal Controls 2.

Mastering Internal Controls and Fraud Prevention 3. Segregation of duties Different employees should be responsible for authorization v. recordkeeping v. Segregation of duties Five Inventory Internal Controls Mastering Internal Controls and Fraud Prevention 4.

Physical safeguards Lock up valuable inventory Restrict access to only authorized parties Consider adding cameras, guards and electronic access logs Five Inventory Internal Controls Mastering Internal Controls and Fraud Prevention 5. Analytical reviews—periodic checks of: COGS as a percentage of Sales is it higher? Five Inventory Internal Controls Mastering Internal Controls and Fraud Prevention Which Employees May Steal?

Experience shows that the employees likely to steal often: Express deep-seated resentment Have an inexplicably lavish lifestyle Have addictions gambling, drugs, alcohol Are overextended indicated by frequent phone calls from creditors Pressure Opportunity Justification Poor internal controls Addictions Overextended Perceived mistreatment Mastering Internal Controls and Fraud Prevention Require drug screening of applicants—and possibly current employees Consult a labor lawyer before implementing Check references—actually call each one Verify degrees, certifications and licenses How to Prevent Employee Mastering payroll homework Mastering Internal Controls and Fraud Prevention Perform internal audits and always include: Expense reports Purchasing records Sales records mastering payroll homework Cash accounts Customer complaints Have the audit performed by someone who does not handle the records audited How to Prevent Employee Theft Mastering Internal Controls and Fraud Prevention Spotting Counterfeits Signs that a check is counterfeit: A slick feel—because on color copies the print is not raised as on genuine checks Lack of texture No watermark or micro printing or hologram —even high-quality offset lithography may lack one Mastering Internal Controls and Fraud Prevention New Check-Printing Technologies New methods of printing help prevent fraud: Prismatic lithography—uses color patterns that are difficult to separate and hard to imitate Scrambled indicia—uses a pattern of colored dots that becomes a word when seen through a colored filter Micro-line—uses a microscopic line of tiny letters Mastering Internal Controls and Fraud Prevention New Check-Printing Technologies Hologram—when a hologram on a check is viewed from different angles, it changes appearance and color Security seal on back—the seal becomes visible when held up to the light Mastering Internal Controls and Fraud Prevention What to Look for When reviewing cancelled company checks: Fan the checks to spot slightly different colors Investigate gaps in check numbering Mastering payroll homework long-outstanding checks Investigate too many second endorsements Mastering Internal Controls and Fraud Prevention Customer Check Fraud To prevent customer check fraud: Have a policy—e.

Mastering Internal Controls and Fraud Prevention Customer Check Fraud Have a strict check acceptance policy Train employees on what to look for Have employees ask for additional ID or consult supervisor if a customer mastering payroll homework Overly polite Especially nervous Aggressive Hurried Overly careful in signing a check Tries to distract employee while writing check Mastering Internal Controls and Fraud Prevention Customer Check Fraud Systems that help prevent fraud include: Bank verification, e.

Mastering Internal Controls and Fraud Prevention Mastering Internal Controls and Fraud Prevention Credit Card Fraud To prevent fraud: Show employees How fraud schemes work How to spot counterfeit and forged credit cards Establish a liaison with local law enforcement For a complete list, see page 47 of your workbook.

Mastering Internal Controls and Fraud Prevention Spotting Scams Employees can be trained to: Spot customer behavior that may indicate fraud workbook page 48 Spot bad cards page 49 Checking a Visa Card Ultraviolet-sensitive dove is visible on the face of the card when placed under an ultraviolet light. A four-digit number must be printed directly below the account number and match exactly the first 4 digits of the account number, mastering payroll homework.

But on a re-embossed card, the numbers may be fuzzy. The hologrammastering payroll homework, a flying dove, should look three- dimensional and seem to move when the card is tilted back and forth, mastering payroll homework. Visa logo should have micro-printing around its border. This printing is barely readable without a magnifying glass. Checking a MasterCard 1. The first four digits of the account number must match the preprinted four-digit BIN bank identification number.

When rotated, the hologram should reflect light and seem to move, mastering payroll homework. Checking a MasterCard 5. Any tampering will smudge or erase some of mastering payroll homework letters. On the signature panel, there mastering payroll homework seven digits—the first four must match the last four of the account number.

Slightly to the right is a printed three-digit CVC2 verification number. This number should match the account number on the back of the card—and the one on the printed receipt. Checking an AMEX 1. The preprinted Identification Number CID verification number is not embossed. It should always appear above the account number, on the right or left edge of the card. Do not accept a card after its expiration date.

The centurion should be printed in the kind of fine detail you see on U. Only the person whose name is embossed on the card may use it—no one else. Mastering payroll homework statement gives American Express the right to take possession of the card at any time.

Checking an Amex Card 7. Some cards have a hologram of the American Express image embedded mastering payroll homework the magnetic strip. The signature panel should not be taped, mutilated, erased or painted over.

Check the signature on the back of the card against the one on the transaction receipt. If a customer gives you an unsigned card, request a photo ID with signature—then ask the customer to sign the card and transaction receipt while you hold the ID. Check with management before implementing this policy. Mastering Internal Controls and Fraud Prevention How Vendors Cheat You Telemarketing scams law enforcement FTC laws enacted in require that: Salespeople must clearly identify themselves and company by name and provide a phone number Vendors must provide certain services and information before demanding payment Vendors may call only between 8 a.

and 9 p.

Pivot Table Excel Tutorial

, time: 13:36MyLab & Mastering | Pearson

3. Mastering Payroll Section 1. Employees v. nonemployees Section 2. Federal v. state laws Section 3. Paying employees under federal law Section 4. Required payroll data Section 5. Form W-4 and state withholding forms Section 6. Withholding and depositing taxes Section 7. Completing federal reporting forms Section 8. When wages are taxable Jul 01, · Homework Solutions 1. Mastering Payroll Similarly,blogger.com,somestatesmaketheclient firmpay. ** Starting in , employers must withhold—and self-employed individuals must pay—additional Medicare tax of % of wages above $, The additional Medicare tax is not reflected in this chart% Mastering Payroll Homework Exercises College essays are even more challenging to write than high school ones, and students often get assigned a lot of them. And while you might handle Mastering Payroll Homework Exercises writing about the subjects you enjoy, writing about the other subjects could be a real struggle

No comments:

Post a Comment