Jan 01, · Patient Satisfaction in Hospitals—The Impact of HCAHPS. The prominence that the government now places on patient satisfaction survey scores has led hospitals to come up with creative ways to improve patient satisfaction. Unfortunately, some of them have no positive health benefits customer satisfaction has got great importance in electronic banking as well. High level of satisfaction is Review Of Literature Review of a few important research papers is made in the following paragraphs with an important objective to identify the research gap that exists at present Levels of Customer Satisfaction. When discussing categories of customer satisfaction levels, Williams and Buswell () refer to Oliver’s theory that divides potential customer satisfaction levels into three categories: First, negative disconfirmation happens when the level of service turns out to be worse than expected by the customer

Literature Review on Banking Services: [Essay Example], words GradesFixer

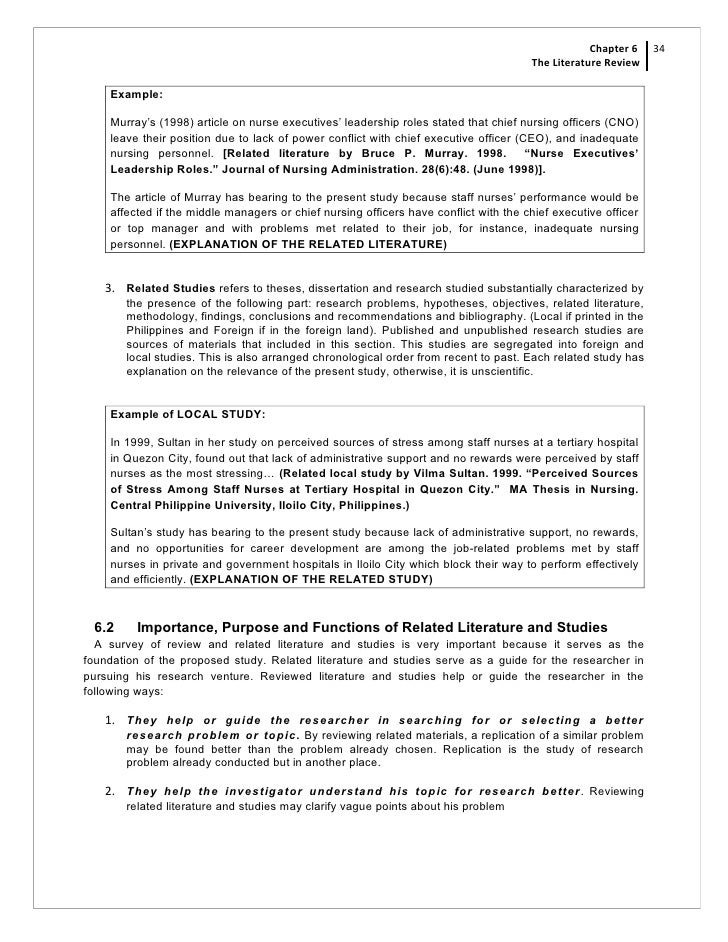

Home — Essay Samples — Business — Banking — Literature Review on Banking Services. It is relevant to refer briefly to the previous studies and research in the related areas of the subject to find out and to fill up the research gaps, a literature review on customer satisfaction. The following are the some studies conducted by the eminent authors and practitioners on the area of service quality of banks.

Dhandabani, Examined the nature of linkage between service quality and customer loyalty in Indian retail banking. Study used confirmatory factor analysis to identify the service quality dimension. The resulted dimensions are Reliability, Responsiveness, Knowledge and recovery; and Tangibles. The structural equation model reveals that there is no significant direct linkage between service quality and customers loyalty.

Maya Basant Lohani, Examined on service quality in selected banks and measured in five dimensions by using SERVQUAL scale developed by Parasuraman et al and revealed that there exist a small perceptual difference regarding overall service quality with the respective banks. The study of found that banks have more concentration on the tangible factor like a computerization, physical facilities, etc.

to attract the customers. He found that customer satisfaction is significantly and positively related with customer loyalty and customer satisfaction is an important mediator between service quality and customer loyalty.

In the last of the study he have discussed that banking service providers should follow right course of action to win customer satisfaction by providing better service quality in order to create loyal customer base.

Desta, Studied by assessing and measuring the banking service quality perception of the SBI branch customers; and examining the relationship between service quality, customer satisfaction and positive word of mouth and found that the expectations of bank a literature review on customer satisfaction were not met and that the largest gap was found in the reliability dimension.

This dimension also had the largest influence on customer satisfaction and overall satisfaction of bank customers had a positive effect on their word-of-mouth. It needs to invest on employee training programs that will provide employees with an understanding of service culture and service excellence particularly at front line levels. Kheng, et al. They opined that a lot of competitive factors in the form of substitutes are forcing bankers to explore the importance of customer loyalty.

Therefore, studies need to focus on the changing role of the banking system. They also found that improvement in service quality can enhance customer loyalty. Rupa Rathee,studied the service quality gaps in banks after nationalization a literature review on customer satisfaction commercial banks. With the entry of new generation, tech-savvy, private banks the banking sector has become too competitive.

Gap analysis was applied to find the gaps between expected and performed service in private banks to find the difference between male and female perception and expectation. This study provided an insight into which attributes of service quality in private bank were most important in providing satisfaction to customers and areas where significant gaps existed. It concluded that the highest gap was found in the dimension of reliability and empathy and suggested that the banks have to reduce this gap giving individual personal attention to understand customer specific needs, a literature review on customer satisfaction.

The customers trust the public sector banks. These banks have existed in the market for a longer period than the private sector banks, a literature review on customer satisfaction. The reliability factor is a positive factor for these banks. Therefore private banks should position themselves in the market on the basis of this dimension and promote themselves aggressively.

It becomes imperative for the private sector banks to train their employees to treat the customers with empathy. Statement of Problem Extensive research has been done by eminent scholars, academicians and practitioners on service quality in the banking industry. All these studies have concentrated on urban areas only.

Hence this research study was undertaken. A literature review on customer satisfaction, et al. This report aimed to determine the quality of services offered by Sepah Bank, and also to study the relationship between the service quality, satisfaction and loyalty. Besides, this research findings show that the customer satisfaction plays the role of a mediator in the effects of service quality on service loyalty. Afsar, et al. They attempted to find the factors of customer loyalty and their relationships with the banking industry in developing countries.

They examined and found that perceived quality, satisfaction, trust, switching cost and commitment are the factors which influence the loyalty of the customers. Joshua Selvakumar studies the impact of Service Quality on Customer Satisfaction in Public Sector and Private Sector Banks. The study examines the a literature review on customer satisfaction of service quality determinants on the degree of customer satisfaction in public and private banks in India.

By realizing the gap between the perceived and actual service quality, customer satisfaction can be extremely improved. Manasa Nagabhushanam conducted a research study on service quality of banks in India. The study encompasses the service quality of all the banks i. The study was conducted to analyze the expected and perceived gap among customers and bankers. Mukta Dewan and Dr. Sadhana Mahajan studied the study of the perceived Service Quality and its Dimensions in Private Sector Banks.

The study examines that there was a significant difference in the perception of service quality and its dimensions for the private sector bank customers for different categories of demographic factors. The perception of male and female customers varied significantly for the overall service quality and its dimensions — reliability, responsiveness, a literature review on customer satisfaction, assurance and empathy. It a literature review on customer satisfaction found that the male customers had a more positive perception of service quality as compared to the female counterparts.

Maya Basant Lohani and Dr. POOJA Bhatia studied the Assessment of Service Quality in Public and Private Sector Banks of India. The study was conducted to ascertain service quality variations across selected banks by demographic variations and to measure the customer satisfaction in selected public and private sector banks by analyzing the gap between expectations and their perceptions of banking services.

Vibhor Jain, Dr. Sonia Gupta and Smrita Jain studied customer perception of service quality in banking sector with special reference to India private banks. The study examines to learn and understand the customer perception regarding service quality and understand the different dimension of service quality in banks.

There is an urgent need for the banking services to reaffirm themselves in view of the cut-throat competition, which is close on the anvil. Nisha Malik and Mr. Chand Prakash Saini studied Private Sector Banks Service Quality and Customer Satisfaction by conducting an Empirical Study of two Private Sector A literature review on customer satisfaction. The aim of proposed study was to find out perception of HDFC and ICICI bank customers regarding to the service quality parameter and gap analysis of expected and acknowledged quality parameters, and also revels the relationship between psychographic factors and satisfaction levels of rural and urban customers.

Akte S. and Ghosh S. The study concludes that in four dimensions like reliability, empathy, tangibility, assurance, a literature review on customer satisfaction, the gap between perceptions and expectations is significant except responsiveness where it is insignificant means banks do not extent that level of services which will satisfy the customers expectations. The study also suggests some recommendations to minimize this gap.

Remember: This is just a sample from a fellow student. Sorry, copying is not allowed on our website. We a literature review on customer satisfaction occasionally send you account related emails.

This essay is not unique. Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper. Want us to write one just for you? We use cookies to personalyze your web-site experience. This essay has been submitted by a student. This is not an example of the work written by professional essay writers.

Literature Review on Banking Services Category: BusinessLiterature Subcategory: Finance Topic: BankingLiterature Review Pages: 3 Words: Published: 10 April Downloads: Download Print. Get help with writing. Pssst… we can write an original essay just for you. Your time is important.

Get essay help. Related Essays Importance of Big Data in Financial Sector Essay. Online Banking: Definition and Features Essay. Pros and Cons of Banking Supervision Essay.

Credit Repair Self Help Essay. Positioning of equity savings funds Essay. Review of the History of Conventional Banking System and Evolution of Banking in Pakistan Essay. Impact of FDI on Indian Banking Sector Essay. Technology Used in E-banking and Its Functions Essay. A Brief History of Technology in Banking Essay.

Find Free Essays We provide you with original essay samples, perfect formatting and styling. Cite this Essay To export a reference to this article please select a referencing style below: APA MLA Harvard Vancouver Literature Review on Banking Services.

Literature Review on Banking Services. Literature Review on Banking Services [Internet]. Order Now. Your essay sample has been sent. Order now. Related Topics Good Country People Essays Jane Eyre Essays Of Mice and Men Essays Young Goodman Brown Essays Pride and Prejudice Essays. Hi there! Are you interested in getting a customized paper? Check it out! Having trouble finding the perfect essay?

How to do a literature review using Google Scholar

, time: 5:52Job satisfaction and motivation: how do we inspire employees?

Review of Literature. The 2 selected dimensions (customer satisfaction, convenience, security, website functionality and customer service) were measured by using a Likert scale measurement Apr 10, · He found that customer satisfaction is significantly and positively related with customer loyalty and customer satisfaction is an important mediator between service quality and customer loyalty. In the last of the study he have discussed that banking service providers should follow right course of action to win customer satisfaction by products online. In order to enhance customer satisfaction and shopping experience, it has become a common practice for online merchants to enable their customers to review or to express opinions on the products that they have purchased. With more and more

No comments:

Post a Comment